Đánh Giá Chi Tiết Các Nhà Cái

Để giúp bạn dễ dàng lựa chọn, chúng tôi sẽ đánh giá khách quan từng nhà cái dưới đây:

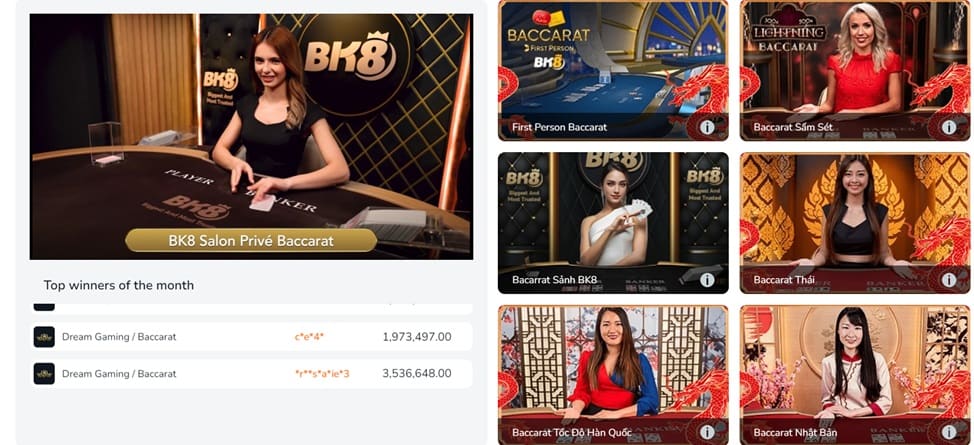

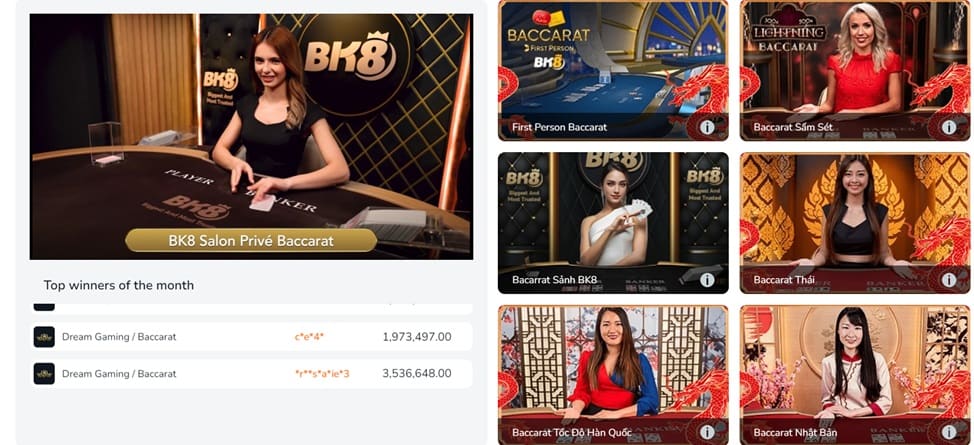

Bk8 – Tham gia chơi Baccarat trực tuyến nhận 200k tiền cược miễn phí

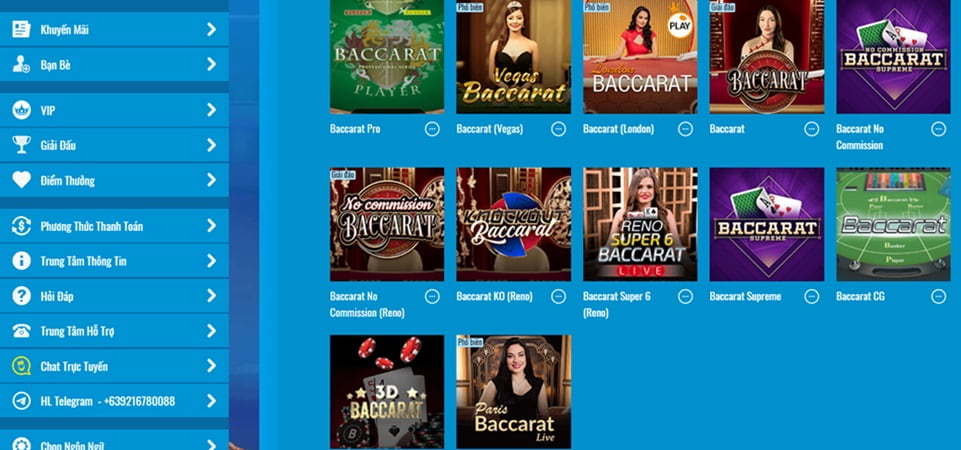

Năm 2015, Godric Investments Limited chính thức đưa Bk8 đi vào hoạt động. Trụ sở chính của nhà cái đặt tại Malta, Philippines. Nhưng chỉ một thời gian ngắn sau, Bk8 đã có mặt ở nhiều quốc gia châu Á, trong đó có Việt Nam và mang tới không ít trò chơi cá cược cực hấp dẫn, và không thể không kể đến game bài Baccarat. Tại Bk8 bạn sẽ có cơ hội trải nghiệm các biến thể Baccarat phiên bản 3D và Live có Dealer thật. Ngoài ra, nhà cái còn dành nhiều khuyến mãi hấp dẫn cho người chơi, ví dụ thưởng 200K freebet.

| Tên công ty | Godric Investments Limited |

| Địa chỉ | Số 02, Spinola Road, St. Julians STJ 3014, Malta |

| Giấy phép | Gaming Curacao |

| Chương trình VIP | Có |

| Ứng dụng | Có |

| Phí | Không |

Ưu điểm:

- Nhà cái trực tuyến hợp pháp, tiềm lực tài chính mạnh

- Cung cấp nhiều biến thể Baccarat và các game bài hấp dẫn khác

- Có app BK8 dành riêng cho điện thoại hệ điều hành IOS và Android

- Chấp nhận nhiều loại tiền tệ, có cả crypto

- Nhiều chương trình khuyến mãi lớn

Nhược điểm:

- Link vào Bk8 thường xuyên bị chặn

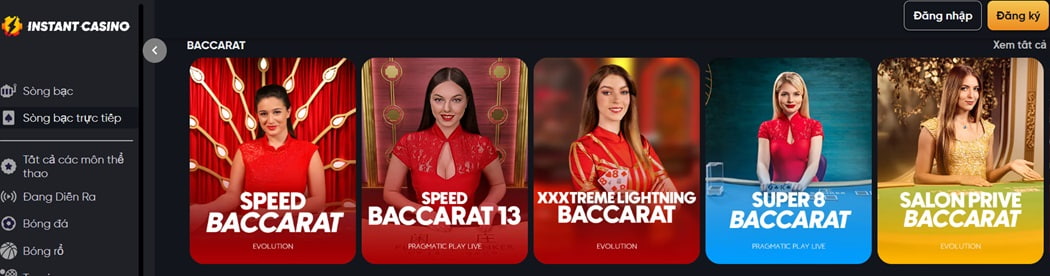

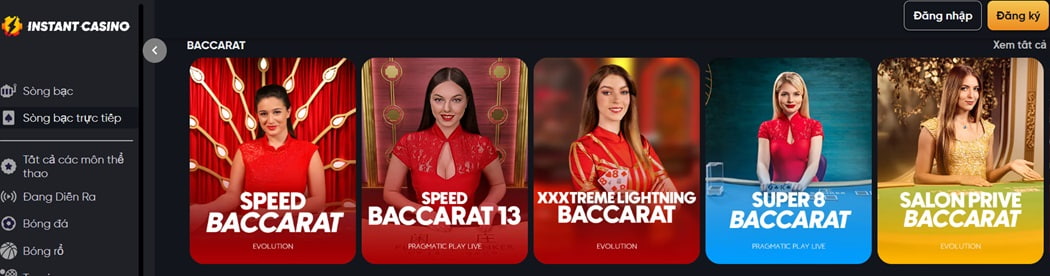

Instant Casino – Địa chỉ chơi Baccarat online mới nhưng uy tín

Hay còn gọi là IC cũng được biết tới là địa chỉ chơi Baccarat trực tuyến đáng tin cậy. Tham gia vào nhà cái bạn sẽ có cơ hội được trải nghiệm nhiều biến thể Baccarat khác nhau. Tất cả đều do nhà phát hành game danh tiếng cung cấp nên đảm bảo chất lượng, không có tình trạng gian lận, thao túng kết quả. Ngoài ra, tại nhà cái còn có nhiều game bài khác thú vị không kém như Poker, Blackjack, Dragon Tiger,…

| Tên công ty | SIMBA N.V. |

| Địa chỉ | Zuikertuintjeweg Z/N (Zuikertuin Tower), Willemstad, Curaçao |

| Giấy phép | Gaming Curacao |

| Chương trình VIP | Có |

| Ứng dụng | Có |

| Phí | Không |

Ưu điểm:

- Nhà cái trực tuyến hợp pháp tới từ châu Âu

- Cung cấp Baccarat cùng nhiều game cá cược chất lượng khác

- Giao diện trực quan, có hỗ trợ tiếng Việt

- Nhiều hình thức nạp và rút tiền miễn phí, tốc độ giải quyết giao dịch nhanh chóng

- Bảo mật thông tin người chơi tốt

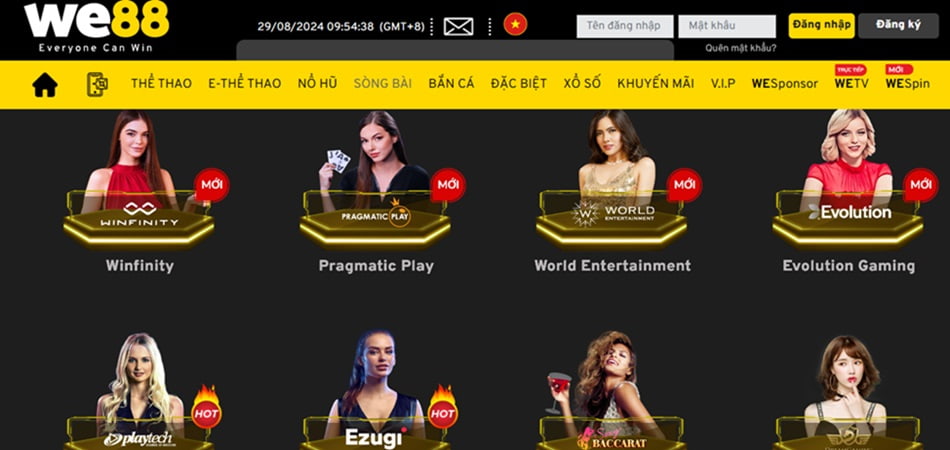

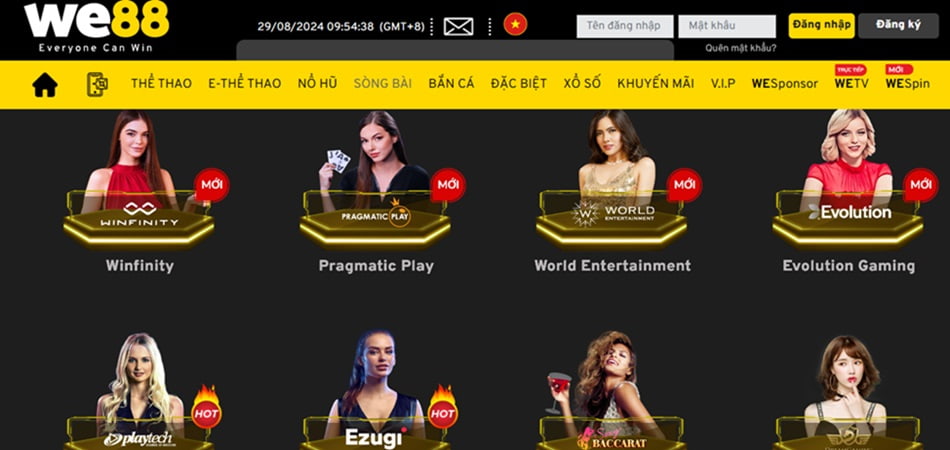

We88 – Chơi Baccarat online an toàn, không lo lộ danh tính

We88 hiện đang sở hữu nhiều sảnh game bài đẳng cấp do các nhà phát hành game lớn xây dựng. Dù bạn lựa chọn tham gia vào bất kỳ sảnh nào cũng đều có thể trải nghiệm game Baccarat. Số lượng bàn chơi Baccarat tại nhà cái rất lớn với nhiều giới hạn cược và cửa cược khác nhau. Đặc biệt, tại các bàn chơi còn có Dealer xinh đẹp chia bài và tương tác với người chơi nên mang tới trải nghiệm giải trí rất chân thực.

| Tên công ty | Moon Technologie NV |

| Địa chỉ | Curacao |

| Giấy phép | Gaming Curacao |

| Chương trình VIP | Có |

| Ứng dụng | Có |

| Phí | Không |

Ưu điểm:

- Nhà cái hợp pháp, có danh tiếng trên thị trường

- Cung cấp đa dạng game cá cược chất lượng

- Cá cược đa nền tảng: website và trên điện thoại Android, iOS

- Tỷ lệ thưởng cao, khuyến mãi giá trị

- Chế độ bảo mật thông tin người dùng tốt

Nhược điểm:

- Tốc độ phản hồi khách hàng hơi chậm trong thời gian cao điểm

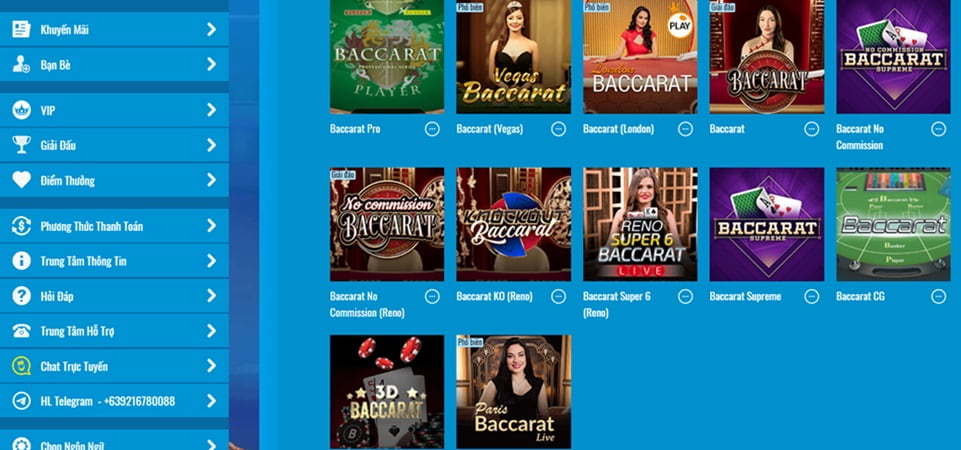

Eu9 – Cung cấp đa dạng biến thể Baccarat với tỷ lệ cược cao

Còn gọi là Eubet cũng đang là điểm cá cược thu hút được nhiều người chơi, đặc biệt là người chơi yêu thích Baccarat. Tới với nhà cái bạn có thể trải nghiệm rất nhiều biến thể Baccarat khác nhau như Speed Baccarat, Super 6 Baccarat, Mini Baccarat,… Biến thể nào cũng có nhiều bàn cược với cửa cược đa dạng. Giới hạn cược cũng rất linh hoạt, phù hợp với tài chính của mọi bet thủ.

| Tên công ty | EU9 Sòng bạc Malaysia |

| Địa chỉ | Wilayah Persekutuan Kuala Lumpur, Malaysia |

| Giấy phép | Curacao Gaming |

| Chương trình VIP | Có |

| Ứng dụng | Có |

| Phí | Không |

Ưu điểm:

- Nhà cái trực tuyến hợp pháp, được Curacao cấp phép

- Có website và App mobile hỗ trợ tiếng Việt

- Nhiều sảnh Casino lớn, cung cấp Baccarat và đa dạng game cá cược

- Các chương trình khuyến mãi hấp dẫn, điều kiện nhận thưởng đơn giản

Nhược điểm:

- Link vào Eu9 thường bị chặn

Happy Luke – Nhà cái Baccarat online uy tín với nhiều sự kiện, giải đấu lớn

Với những bet thủ chơi game bài online lâu năm chắc không còn xa lạ với Happy Luke nữa. Đây là một nhà cái lớn, giàu thâm niên, chuyên cung cấp các game bài hấp dẫn như Blackjack, Dragon Tiger, Poker,… và đặc biệt là Baccarat. Hơn nữa, nhà cái còn thường xuyên tổ chức các giải đấu game Baccarat với tổng giá trị giải thưởng lớn để thành viên nhà cái có cơ hội tham gia so tài.

| Tên công ty | Class Innovation B.V |

| Địa chỉ | Fransche Bloemweg 4, Willemstad, Curaçao |

| Giấy phép | Curacao |

| Chương trình VIP | Có |

| Ứng dụng | Có |

| Phí | Không |

Ưu điểm:

- Nhà cái trực tuyến lớn, giàu thâm niên

- Website và App mobile thiết kế trực quan, dễ dàng cá cược

- Mức cược linh hoạt, tỷ lệ thưởng cao

- Khuyến mãi giá trị với điều kiện nhận thưởng đơn giản

Nhược điểm:

- Thể loại game cá cược chưa đa dạng

Aw8 – Cung cấp các sảnh chơi bài Baccarat qua mạng đẳng cấp

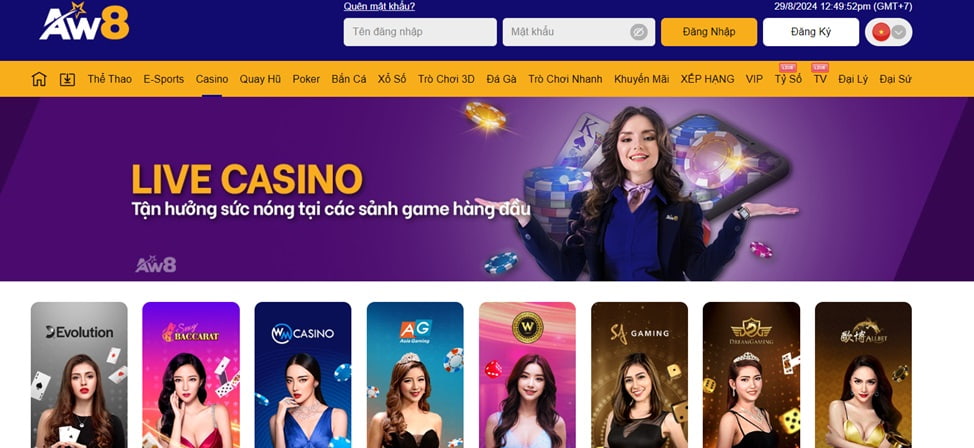

Chơi Baccarat trực tuyến tại Aw8 cũng là một lựa chọn đáng để cân nhắc. Đây không chỉ là nhà cái trực tuyến uy tín mà còn có tiềm lực tài chính mạnh, cách thức hoạt động chuyên nghiệp. Đến với nhà cái bạn có thể chơi Baccarat online bằng cả tiền fiat và crypto tại nhiều sảnh chơi đẳng cấp được xây dựng bởi WM Casino, AG Gaming, SA Gaming, Dream Gaming,… Tại các sảnh chơi này còn có không ít game cá cược khác lôi cuốn không kém, mang lại cho bạn cơ hội ăn thưởng cao.

| Tên công ty | Aw8 |

| Địa chỉ | Philippines |

| Giấy phép | PAGCOR |

| Chương trình VIP | Có |

| Ứng dụng | Có |

| Phí | Không |

Ưu điểm:

- Nhà cái trực tuyến an toàn, hợp pháp

- Cá cược đa nền tảng, trên website và ứng dụng di động

- Đa dạng hình thức thanh toán với tốc độ giao dịch tức thì

- Bảo mật thông tin người chơi tốt

Nhược điểm:

- Tên tuổi còn khá mới tại thị trường cá cược Việt Nam

Vn88 – Chơi Baccarat online dễ dàng, mọi lúc mọi nơi

Nhà cái Vn88 là địa chỉ chuyên cung cấp các game bài online được sản xuất từ những nhà phát hành game cá cược lớn. Trong đó có cả game bài Baccarat. Số lượng bàn chơi Baccarat tại nhà cái lớn lại có nhiều mức cược khác nhau để bạn lựa chọn. Thêm vào đó, các bàn chơi còn có Dealer trẻ trung, xinh đẹp và quyến rũ vừa chia bài, vừa sẵn sàng tương tác với người chơi. Đặc biệt, tỷ lệ thưởng cho người chơi tại các cửa cược Baccarat của Vn88 có phần cao hơn so với mặt bằng chung.

| Tên công ty | Marquee Holdings Limited |

| Địa chỉ | Philippines |

| Giấy phép | PAGCOR |

| Chương trình VIP | Có |

| Ứng dụng | Có |

| Phí | Không |

Ưu điểm:

- Nhà cái uy tín, luôn nằm trong TOP 10 nhà cái uy tín nhất

- Chơi Baccarat và nhiều game cá cược khác dễ dàng trên website hoặc App mobile Vn88

- Hỗ trợ nhiều phương thức nạp rút tiền với thủ tục đơn giản

- Nhiều chương trình khuyến mãi lớn

- Dịch vụ CSKH chu đáo

Nhược điểm:

- Link vào VN88 thường xuyên bị chặn

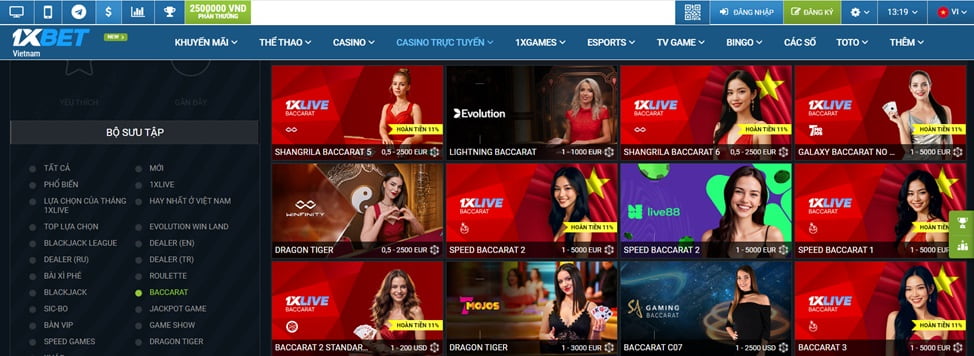

1xbet – Hỗ trợ cá cược game bài Baccarat bằng tiền fiat và crypto

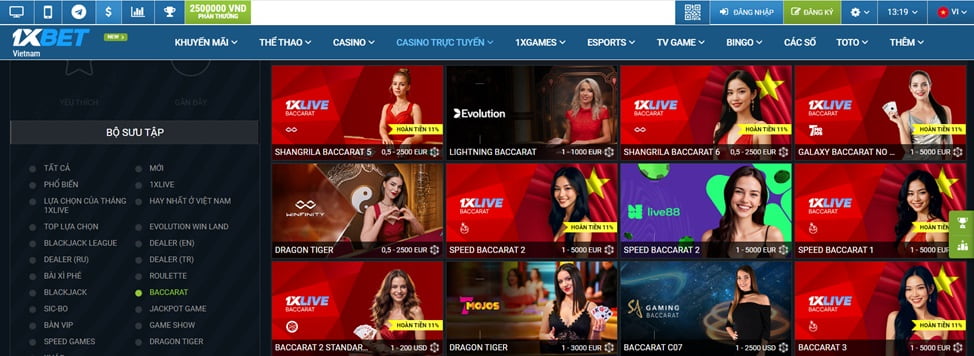

Kể từ khi đi vào hoạt động cho tới nay, 1xbet luôn nỗ lực để mang tới cho người chơi các tựa game hấp dẫn và chất lượng. Trong đó nổi bật phải kể tới Baccarat trực tuyến. Game được cung cấp dưới dạng phiên bản Live có Dealer thật. Các game đều tới từ nhà phát hành game tên tuổi nên có giao diện trực quan, hoạt động ổn định, hình ảnh sắc nét và đảm bảo 100% kết quả hoàn toàn ngẫu nhiên. Ngoài ra, 1xbet còn cung cấp cả game Dragon Tiger, Roulette, Sicbo, Poker,…

| Tên công ty | Giskard Datatech Ovt. Ltd |

| Địa chỉ | Limassol, Cyprus |

| Giấy phép | Curaçao eGaming License |

| Chương trình VIP | Có |

| Ứng dụng | Có |

| Phí | Không |

Ưu điểm:

- Nhà cái uy tín tới từ châu Âu

- Website và App mobile thiết kế giao diện trực quan

- Hỗ trợ cá cược online bằng cả tiền fiat và crypto

- Giá trị các khuyến mãi cho người chơi cao

- Bảo mật thông tin người chơi tuyệt đối

Nhược điểm:

- Số lượng khuyến mãi chưa nhiều

Fb88 – Trải nghiệm Baccarat cùng nhiều game bài online hấp dẫn

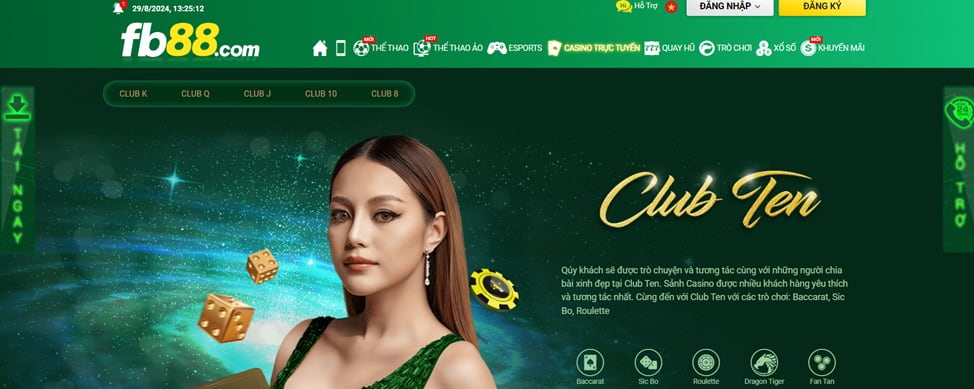

Có rất nhiều bet thủ Việt hiện đang tham gia chơi Baccarat trực tuyến tại Fb88. Đó là bởi Fb88 thực sự là một nhà cái uy tín, hợp pháp lại cung cấp game Baccarat chất lượng. Bạn có thể tham gia vào các sảnh game Club K, Club Q, Club J, Club 10 và Club 8 của nhà cái để trải nghiệm Baccarat cùng nhiều trò chơi khác như Fantan, Blackjack, Win 3 Cards, Sicbo, Roulette,… cùng các Dealer trẻ trung và xinh đẹp.

| Tên công ty | Tập đoàn Fi88 Group |

| Địa chỉ | Philippines |

| Giấy phép | PAGCOR |

| Chương trình VIP | Có |

| Ứng dụng | Có |

| Phí | Không |

Ưu điểm:

- Nhà cái cá cược lâu năm, được PAGCOR cấp phép kinh doanh

- Chơi game dễ dàng trên website và App mobile nhà cái

- Trò chơi có tỷ lệ ăn thưởng cao

- Số lượng khuyến mãi lớn và có giá trị thưởng khủng

- Dịch vụ CSKH chu đáo, 24/7

Nhược điểm:

- Link vào Fb88 tại Việt Nam thường bị chặn

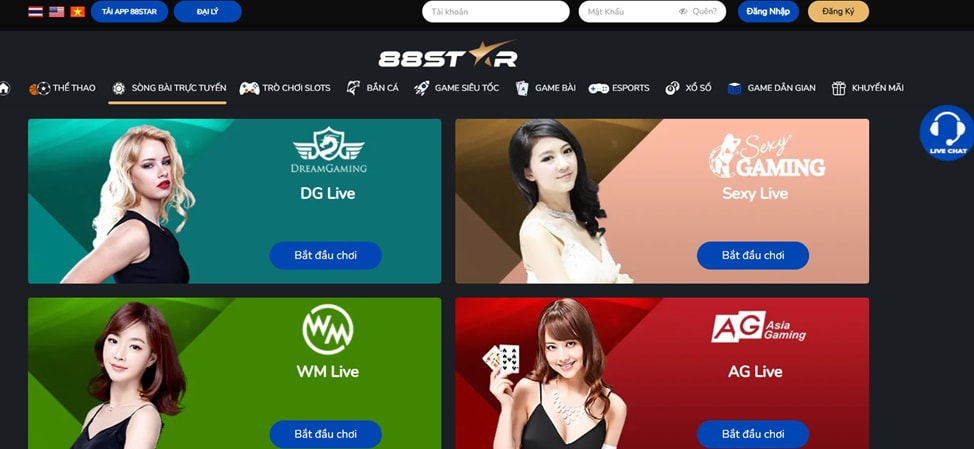

88STAR – Chơi Baccarat online và nhận nhiều khuyến mãi giá trị

Thêm một địa chỉ chơi Baccarat trực tuyến nữa cũng rất an toàn và chuyên nghiệp lại có nhiều khuyến mãi hấp dẫn đó chính là 88STAR. Đây là nhà cái hợp pháp, được chính phủ Curacao cấp phép. 88STAR hiện đang sở hữu nhiều sòng bài lớn và dù bạn tham gia vào bất kỳ sòng bài nào cũng có thể trải nghiệm Baccarat. Nhà cái đưa ra cho người chơi nhiều mức cược khác nhau cùng tỷ lệ ăn thưởng rất cao.

| Tên công ty | 88STAR |

| Địa chỉ | Malta, Philippines |

| Giấy phép | Gaming Curacao |

| Chương trình VIP | Có |

| Ứng dụng | Có |

| Phí | Không |

Ưu điểm:

- Nhà cái hợp pháp, có quy mô lớn

- Ngoài Baccarat còn có nhiều game bài khác để người chơi trải nghiệm

- Có thể chơi game trên website và App mobile 88STAR

- Hỗ trợ nạp rút tiền nhanh, không mất phí

- Hệ thống bảo mật thông tin hiện đại

Nhược điểm:

- Chưa có nhiều khuyến mãi nhưng giá trị các khuyến mãi cao